Payoneer vs Wise: Which global payment solution should I choose?

Table of contents

Payoneer vs Wise: overview

What's the difference between Payoneer and Wise?

Payoneer pros and cons

Wise pros and cons

Payoneer compared to Wise

Wise compared to Payoneer

Features comparison

Payoneer vs Wise: Which is the best for your business?

Promotions on Payments software

Alternatives to Payoneer & Wise

Selecting the appropriate international payment solution is essential for managing your global financial transactions effectively. Whether you're a freelancer, e-commerce business, or a global traveler, having the right payment platform can streamline cross-border payments, save on fees, and optimize currency exchange rates. Additionally, it can provide you with the convenience of sending and receiving money across borders with ease.

With numerous options available, making the right choice between Payoneer and Wise can significantly impact your financial operations. In this article, we'll guide you through a comprehensive comparison of these two renowned international payment service providers. By examining their key features, fees, exchange rates, and user experiences, you'll be better equipped to choose the ideal solution that aligns with your specific financial needs.

Payoneer vs Wise: overview

Payoneer and Wise are prominent players in the world of international payments and currency exchange, each offering unique advantages tailored to suit specific user requirements.

Payoneer is renowned for its comprehensive global payment solutions, making it a top choice for freelancers, e-commerce businesses, and professionals seeking a versatile platform for sending and receiving funds worldwide. In contrast, Wise specializes in cost-effective international money transfers with transparent fees and real exchange rates. It's particularly appealing to individuals and businesses looking to save on currency conversion costs and enjoy fast, cross-border transactions.

To make an informed decision between Payoneer and Wise, it's essential to consider your specific financial needs, transaction volumes, and preferences. Payoneer may be the right choice if you require a robust, all-in-one solution for managing your international finances, while Wise shines as a smart option for straightforward, cost-effective currency transfers and payments.

Payoneer

|

Wise

|

Comments | |

| Customer Reviews | 4.0 out of 5

|

5.0 out of 5

|

Payoneer is appreciated for its wide range of services and global reach, particularly for freelancers and businesses. Wise is highly praised for its transparency, low fees, and real exchange rates. |

| Pricing Plan | 3.0 out of 5

|

5.0 out of 5

|

Payoneer's fee structure can be complex and sometimes high, particularly for currency conversion. Wise is known for its low, transparent fees and use of the mid-market exchange rate. |

| Customer Support | 3.0 out of 5

|

4.0 out of 5

|

Payoneer offers decent customer support, but some users report long wait times and issues with account blocks. Wise is known for its responsive customer support and efficient service. |

| Currency coverage | 5.0 out of 5

|

5.0 out of 5

|

Both Payoneer and Wise offer extensive currency coverage, making them suitable for global transactions. |

| Integrations | 4.0 out of 5

|

3.0 out of 5

|

Payoneer integrates well with several marketplaces and freelance platforms, making it a popular choice for online sellers and freelancers. Wise has limited integrations since it's focused more on personal and business transfers. |

| Transfer speed | 4.0 out of 5

|

5.0 out of 5

|

Payoneer offers fast transfer speeds, but this can vary based on the method. Wise is known for its speedy transfers, often completing transactions within 1-2 business days. |

| Security | 5.0 out of 5

|

5.0 out of 5

|

Both platforms adhere to high security standards to protect user funds and personal information. |

| Additional services | 5.0 out of 5

|

3.0 out of 5

|

Payoneer provides additional services like billing services, mass payouts, and working capital solutions. Wise is primarily focused on currency exchange and transfers. |

| Ease of Use | 4.0 out of 5

|

5.0 out of 5

|

Payoneer's platform is user-friendly but can be complex due to its wide range of services. Wise is praised for its straightforward, easy-to-use interface. |

| Mobile app experience | 4.0 out of 5

|

5.0 out of 5

|

Payoneer's mobile app is functional and convenient. Wise's app is highly rated for its usability and features, such as the ability to track transfers and manage balances. |

What's the difference between Payoneer and Wise?

Payoneer and Wise are both prominent players in the realm of international financial services, each offering distinct approaches to managing cross-border transactions and currency exchange. Understanding the differences between these two platforms can guide you toward the most suitable choice for your global financial needs.

Payoneer is known for its versatility and comprehensive suite of global payment solutions. It caters to a wide range of users, including freelancers, e-commerce businesses, and professionals seeking a one-stop solution for international transactions. Payoneer offers multi-currency receiving accounts, a prepaid Mastercard for easy access to funds, and competitive exchange rates. This makes it an excellent choice for individuals and businesses looking for a versatile platform to manage their international finances.

On the other hand, Wise, formerly known as TransferWise, specializes in providing cost-effective international money transfers. It stands out for its transparent fee structure and real exchange rates, which often result in significant savings compared to traditional banks. Wise is particularly attractive to individuals and businesses that prioritize cost-efficiency in cross-border transactions and value fast, transparent, and low-cost currency conversions.

One significant difference between Payoneer and Wise lies in their core offerings. Payoneer offers a more comprehensive set of financial services, including multi-currency receiving accounts and a prepaid card, making it suitable for various financial needs. In contrast, Wise's primary focus is on providing a reliable, cost-effective, and straightforward platform for international money transfers.

Additionally, the fee structures and exchange rate policies of Payoneer and Wise differ significantly. Payoneer may charge fees for various services, while Wise is renowned for its transparent fees, which are often lower than those of traditional banks.

Payoneer pros and cons

What are the advantages of Payoneer?

- Global reach: Payoneer is available in over 200 countries and supports multiple currencies, making it an excellent choice for individuals and businesses with international clients or partners.

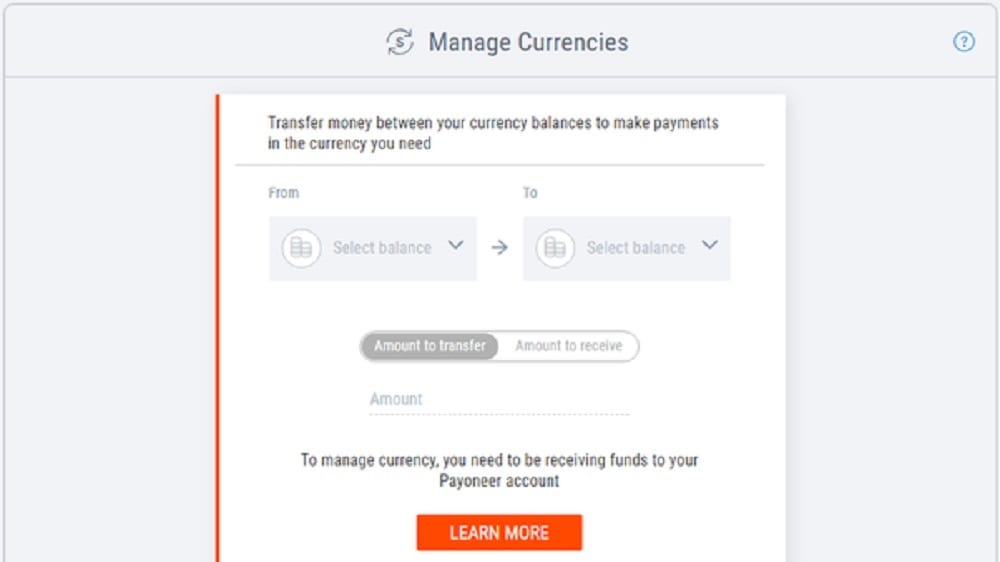

- Multi-currency accounts: Payoneer offers users the ability to hold multiple currency balances, allowing you to receive, hold, and transfer funds in various currencies without the need for multiple bank accounts.

- Prepaid Mastercard: Payoneer provides users with a prepaid Mastercard, which can be used for online and in-store purchases or to withdraw cash from ATMs worldwide, offering flexibility and convenience.

- Integration with marketplaces: Payoneer has partnerships with various online marketplaces and platforms, making it easy for freelancers and e-commerce sellers to receive payments directly from these platforms.

- Competitive fees: Payoneer generally offers competitive fees for currency conversion and international money transfers, often lower than traditional banks.

What are the disadvantages of Payoneer?

- Fees for some services: While Payoneer offers competitive fees, there are still charges associated with certain services, such as card maintenance fees, ATM withdrawal fees, and currency conversion fees.

- Limited customer support: Some users have reported challenges in accessing responsive customer support from Payoneer, which can be frustrating if you encounter issues or have questions.

- Account freezes: Payoneer has been known to freeze accounts temporarily for security reasons or due to regulatory compliance checks, causing inconvenience for users.

- Limited banking services: Payoneer primarily focuses on cross-border payments and may not offer the same range of banking services as traditional banks, such as lending or savings accounts.

- Not ideal for large transactions: Payoneer may not be the best choice for large international transactions due to its daily transaction limits, which could be restrictive for some businesses.

Wise pros and cons

What are the advantages of Wise?

- Transparent fees: Wise is known for its transparent fee structure. They provide real exchange rates and charge a clear, upfront fee for international money transfers. This often results in lower costs compared to traditional banks.

- Low-cost currency conversion: Wise offers competitive currency conversion rates, making it an affordable option for individuals and businesses dealing with cross-border transactions.

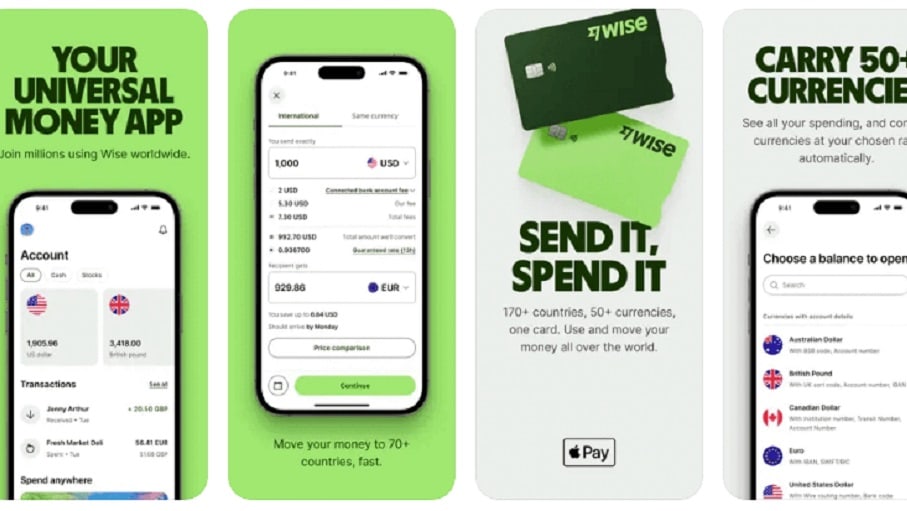

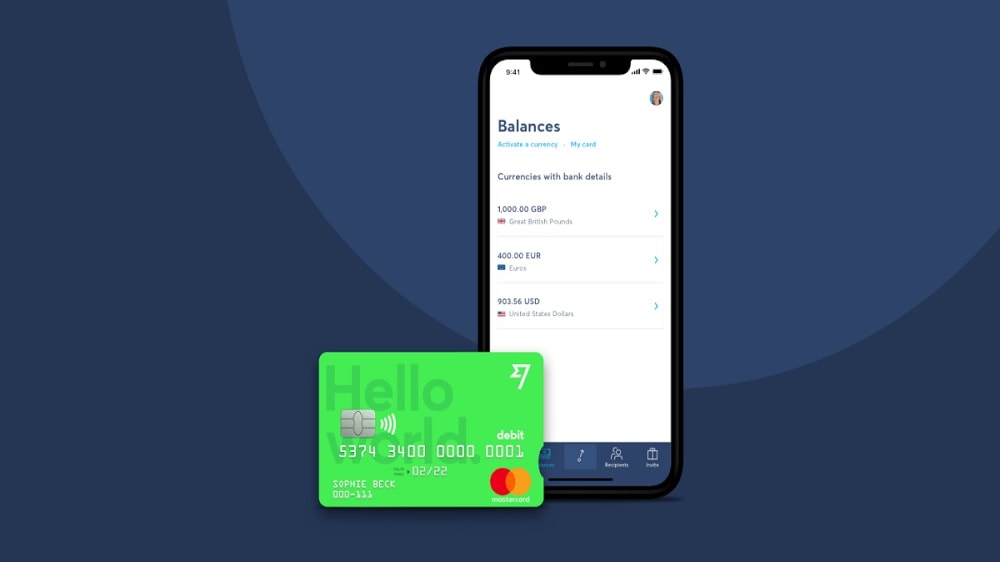

- Multi-currency account: Wise provides users with a multi-currency account that allows you to hold and manage funds in multiple currencies. This can be especially useful for those who frequently deal with international payments.

- Fast and convenient: Transfers with Wise are often faster than traditional bank transfers. Many transactions are completed within hours, which is advantageous for urgent payments.

- User-friendly: Wise's platform is user-friendly, with an intuitive interface that makes it easy to set up and manage international transfers. They also offer a mobile app for added convenience.

What are the disadvantages of Wise?

- Limited services: Wise primarily focuses on international money transfers and currency exchange. It doesn't offer a full suite of banking services like traditional banks, such as savings accounts or loans.

- Bank-to-bank transfers only: Wise primarily supports bank-to-bank transfers, so it may not be the ideal choice for sending funds to individuals who don't have a bank account.

- Transaction limits: Wise has transaction limits, which may restrict large transfers. For significant transactions, you might need to go through additional verification steps.

- Withdrawal fees: While Wise offers a multi-currency account, withdrawing funds to your local bank account may incur a fee, depending on the currency and destination.

- Account verification: Some users may find the account verification process to be more rigorous compared to other financial platforms, which can take longer to complete.

Compare Wise to other tools

Payoneer compared to Wise

Payoneer and Wise are two well-known international payment platforms. Payoneer offers versatility with its multi-currency accounts, prepaid Mastercard, and extensive global reach. It's suitable for various financial needs and businesses.

On the other hand, Wise, known for its transparent fee structure and real exchange rates, excels in cost-effective international money transfers. It's favored for its simplicity and affordability. Choosing between them depends on your specific requirements; Payoneer is a comprehensive solution, while Wise is an efficient choice for straightforward, low-cost currency conversions and transfers.

Is Payoneer better than Wise?

When comparing Payoneer and Wise, it's important to delve deeper into their distinct offerings. Payoneer stands out for its diverse services catering to businesses and freelancers, offering an array of financial tools beyond simple money transfers. This includes billing services, mass payouts, and integrations with various e-commerce platforms.

Wise, meanwhile, appeals to individuals and businesses seeking a straightforward, no-frills approach to currency exchange and transfers. Its user-friendly interface and emphasis on low fees for both personal and business accounts make it a go-to for those prioritizing cost and simplicity in international transactions.

What is Payoneer best used for?

Payoneer is best used for facilitating international payments and cross-border transactions. It serves freelancers, e-commerce businesses, and professionals seeking a versatile platform to send and receive funds globally. Payoneer's multi-currency accounts, prepaid Mastercard, and competitive exchange rates make it ideal for individuals and businesses looking to manage their international finances efficiently. It simplifies cross-border payments, offers flexibility in handling multiple currencies, and enables easy access to funds through the prepaid card.

Payoneer is particularly valuable for those who engage in global trade, work with international clients, or need a convenient way to access and manage funds from different parts of the world.

Can Payoneer replace Wise?

While Payoneer and Wise are both popular international payment solutions, they serve different purposes and have distinct strengths. Payoneer offers a versatile platform for managing global finances, including multi-currency accounts and a prepaid Mastercard, making it suitable for various financial needs.

Wise, on the other hand, excels in cost-effective currency conversion and international money transfers with transparent fees. While Payoneer can replace Wise for some users, it may not be the best choice for those primarily seeking low-cost transfers. The decision to replace one with the other should be based on your specific requirements and whether they align with the strengths of each platform.

Is Payoneer cheaper than Wise?

Payoneer and Wise each have their own fee structures and advantages. Generally, Wise is often considered more cost-effective for straightforward international money transfers due to its transparent fee system and real exchange rates.

Payoneer’s pricing structure, on the other hand, offers a broader range of services, which may include different fee types, such as card maintenance fees or withdrawal charges. The relative cost-effectiveness of one over the other depends on the specific financial services and currency exchange needs of the user. To determine which is cheaper, it's crucial to compare the fees associated with your intended transactions and select the platform that aligns with your requirements.

Is there a better Payments software than Payoneer?

When it comes to international payment solutions, it's essential to explore alternative options to ensure you find the best fit for your specific financial needs.

Several notable alternatives to Payoneer in the realm of international payments include Wise, PayPal, Revolut, and Skrill.

Selecting the ideal international payment platform depends on your unique requirements, transaction volumes, and preferences. If you value versatility, multi-currency accounts, and a prepaid Mastercard, Payoneer may be a strong contender.

Wise compared to Payoneer

Wise and Payoneer are two prominent players in the world of international payments. Wise, known for its transparent fee structure and real exchange rates, excels in cost-effective currency conversion and international money transfers. It's favored for its simplicity and affordability.

Payoneer, on the other hand, offers versatility with its multi-currency accounts, prepaid Mastercard, and extensive global reach. It's suitable for various financial needs and businesses. While both are valuable solutions, your choice between Wise and Payoneer should align with your specific international financial goals, whether it's efficient currency transfers or comprehensive financial management.

Is Wise better than Payoneer?

In the debate of Wise versus Payoneer, it's crucial to consider the nuanced aspects of each service. Wise's strength lies in its straightforward approach, particularly beneficial for individuals and small businesses focused on regular international transfers. Its acclaimed ease of use and transparent pricing system ensures users are well-informed about the costs involved in each transaction.

Conversely, Payoneer's diverse offerings, including its ability to handle larger business transactions and provide more extensive financial services, cater to a different market segment. Those seeking an all-encompassing financial platform may find Payoneer more aligned with their needs.

What is Wise best used for?

Wise is best used for facilitating cost-effective and transparent international money transfers and currency conversion. It's a valuable tool for individuals, businesses, freelancers, and expatriates looking to send and receive money across borders while minimizing excessive fees.

With Wise, users can access real exchange rates and clear fee structures, ensuring they get the most value for their international transactions. Its straightforward platform simplifies the process of converting and transferring funds, making it an ideal choice for those who prioritize efficiency and affordability in cross-border financial activities. Wise empowers users to manage their global finances with ease and transparency.

Can Wise replace Payoneer?

Wise and Payoneer, while both serving international payment needs, have distinct strengths. Wise specializes in cost-effective international money transfers with transparent fees and real exchange rates, making it a strong choice for straightforward currency conversions. On the other hand, Payoneer offers a more comprehensive suite of financial services, including multi-currency accounts and a prepaid Mastercard, catering to various financial needs.

Whether Wise can replace Payoneer depends on your specific requirements. If you prioritize efficient, low-cost cross-border transfers, Wise may suffice. However, if you seek a broader range of international financial tools, Payoneer's versatility might be a better fit.

Is Wise cheaper than Payoneer?

The cost-effectiveness of Wise compared to Payoneer depends on the specific financial services you require. Wise’s pricing structure is often considered more cost-effective for international money transfers due to its transparent fee structure and real exchange rates, which can result in savings compared to traditional banks.

Payoneer, on the other hand, offers a broader range of services, potentially including various fee types such as card maintenance or withdrawal charges. To determine which is cheaper for your needs, it's essential to compare the fees associated with your intended transactions on both platforms.

Is there a better Payments software than Wise?

While Wise is a popular choice for international money transfers and currency exchange, it's essential to explore alternative financial platforms to determine the best fit for your specific needs.

Several notable alternatives to Wise in the realm of international payments include Payoneer, wamo, Revolut, and Stripe.

Choosing the right international payment solution depends on your unique financial requirements, transaction volumes, and preferences. If you prioritize cost-effective currency conversion and straightforward money transfers, Wise might be a strong contender.

Features comparison

Wise Provides More Efficient Low-Cost International Transfers than Payoneer

Comparing the global payment solutions of Payoneer and Wise reveals a significant divergence in their approach to cost-effectiveness. Wise shines with its reputation for delivering highly cost-effective international money transfers. It stands out by charging minimal and transparent fees, often significantly lower than the conventional charges imposed by banks. For instance, when conducting cross-border transactions or currency conversions, users can trust Wise to offer competitive rates and minimize the impact of fees on their finances.

Conversely, while Payoneer boasts an extensive global reach and offers a range of financial services, it does not explicitly emphasize low-cost transfers as one of its primary features. While it may offer competitive rates in some cases, Wise is renowned for consistently delivering cost-effective solutions for users seeking to optimize their international financial transactions.

Payoneer's Extensive Integration Ecosystem Outpaces Wise

In terms of integration possibilities, both Payoneer and Wise offer some useful options. Payoneer excels in catering to the e-commerce sector, with seamless integrations with renowned platforms like Amazon and Shopify. This feature proves highly advantageous for online businesses, simplifying payment processes and streamlining financial transactions. Payoneer further extends its utility by integrating effectively with popular freelance marketplaces such as Upwork and Fiverr, facilitating hassle-free cross-border payments for freelancers.

In contrast, Wise distinguishes itself in the realm of accounting software integration, notably with solutions like Xero. This makes it an excellent choice for businesses seeking efficient financial management and streamlined accounting practices. Moreover, Wise's API integration capabilities offer enhanced flexibility, enabling businesses to customize their payment solutions to align precisely with their unique requirements.

Payoneer has Better Competitive Exchange Rates than Wise

Payoneer stands out for its finely-tuned process, guaranteeing competitive exchange rates. This optimization not only ensures cost-effectiveness but also maximizes the user's earnings by minimizing foreign exchange costs. For example, when receiving payments in various currencies, Payoneer's rates often prove advantageous for businesses and individuals alike.

Conversely, Wise adopts a real-time exchange rate system, known for its fairness and accuracy. While these rates are transparent and reliable, they may not consistently deliver the most competitive options in the market. Users can rely on Wise for accurate conversions, making it a trustworthy choice, but for those who prioritize maximum cost savings, Payoneer's optimized approach often provides a more financially favorable outcome.

Wise’s Borderless Debit Card is More Practical than Payoneer’s Multiple Withdrawal Options

Wise's borderless debit card stands out as a valuable asset for international payments and travel. It automatically converts currencies at the lowest possible charge, ensuring cost-effective and seamless transactions for users across the globe. For instance, when using the Wise debit card to make purchases or withdraw cash abroad, users benefit from competitive exchange rates, minimizing the impact of currency conversion fees on their finances.

On the other hand, Payoneer offers various withdrawal options, including local bank transfers and ATMs, which provide users with flexibility in accessing their funds. However, Payoneer does not provide a multi-currency debit card, which gives Wise a slight edge in this particular feature. Wise's borderless debit card simplifies cross-border spending and is particularly advantageous for individuals and businesses engaged in international transactions.

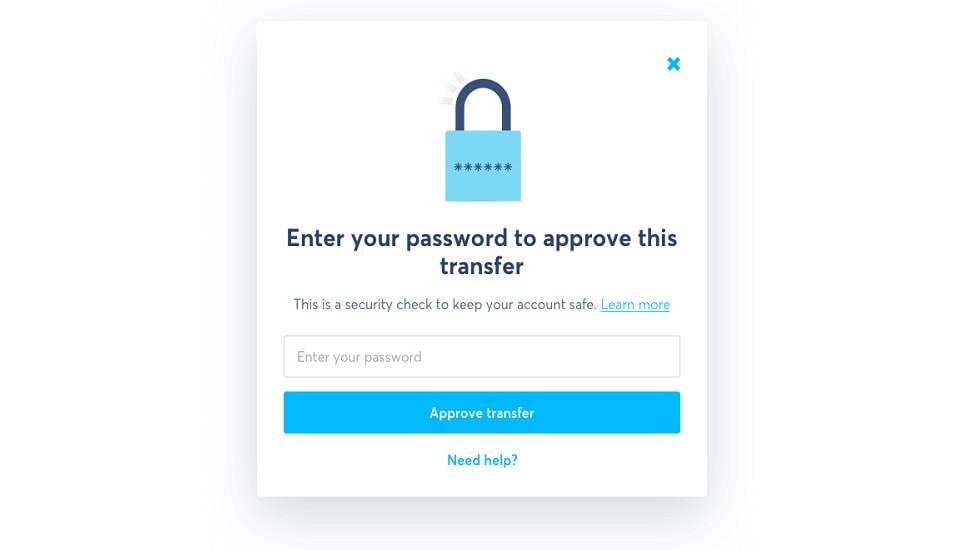

Wise’s Advanced Security Measures is Superior to Payoneer’s Standard Measures

Security is integral to financial transactions. While Payoneer does not explicitly detail its security measures, Wise takes pride in its robust security infrastructure.

Wise employs advanced encryption and stringent security protocols to safeguard users' financial information and transactions. This commitment to security ensures that sensitive data remains protected from potential threats. For example, Wise employs end-to-end encryption to secure all communication and transactions, and it has implemented multi-factor authentication (MFA) to add an extra layer of protection.

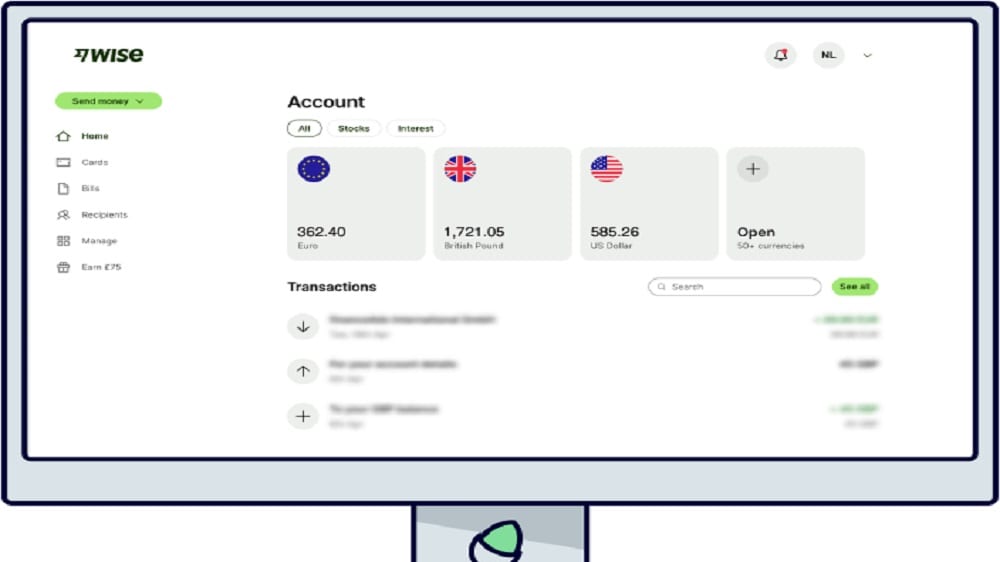

Wise Proves More User-Friendly than Payoneer

When assessing the user-friendliness of Payoneer and Wise, distinctive characteristics emerge, influencing the ease of navigating these international payment platforms. Payoneer stands out with its highly intuitive interface, offering a comprehensive yet straightforward presentation of its diverse features. This accessibility caters to users across different expertise levels, ensuring a hassle-free experience.

On the contrary, Wise is lauded for its minimalistic and clean interface design, prioritizing simplicity. Where Wise gains an advantage is in the efficiency of accessing vital functions. With fewer clicks required to reach essential features, Wise optimizes user interactions for swift and seamless transactions. This efficiency empowers users to allocate more time and focus to their core business activities, setting it apart in the user experience aspect.

Payoneer and Wise Offer Equally Useful Multiple Currency Accounts

Both Payoneer and Wise offer the convenience of managing funds in multiple currencies. Payoneer's "Global Payment Solutions" and Wise's "Multi-currency Accounts" serve a common purpose, allowing users to navigate the complexities of international finance effortlessly. These features empower users to conduct cross-border transactions and engage in global business seamlessly, regardless of the currencies involved.

For instance, Payoneer's multi-currency receiving accounts provide individuals and businesses with the flexibility to receive payments in different currencies and then access these funds conveniently using their Payoneer Mastercard or through bank transfers. Similarly, Wise's multi-currency accounts enable users to hold, send, and receive funds in various currencies, reducing the need for constant currency conversion and minimizing associated costs.

Subscribe to our newsletters.

No FOMO here. Stay up-to-date on all the latest deals and news with our monthly newsletter straight to your inbox like 84,000+ entrepreneurs (+ Get 10% off on on our Premium Membership!)

Payoneer vs Wise: Which is the best for your business?

Payoneer is the best tool for you if:

- You're a freelancer or business owner needing a robust platform for international client billing, as Payoneer offers invoicing features and easy integration with numerous freelance marketplaces.

- Your business requires mass payouts, as Payoneer provides efficient solutions for sending bulk payments globally, ideal for companies with international employees or affiliates.

- You need a multi-currency account to receive and hold funds in different currencies, reducing the need for constant currency conversion and aiding in global transactions.

- You're looking for a financial tool that offers a prepaid Mastercard, enabling direct access to funds for online purchases or ATM withdrawals in multiple countries.

- You value a wide-reaching global network, as Payoneer's extensive international presence supports cross-border payments in numerous countries and currencies, essential for global entrepreneurs.

Wise is the best tool for you if:

- You prioritize transparent, low-cost international money transfers, as Wise offers real exchange rates and clear fee structures, making it ideal for budget-conscious individuals and businesses.

- Simplicity and ease of use are key for you, with Wise's intuitive platform allowing for quick and straightforward cross-border payments without the need for complex financial knowledge.

- You regularly engage in small to medium-sized international transactions and need a service that minimizes fees and simplifies the process, making Wise a cost-effective choice.

- You require a multi-currency account for holding and managing money in various currencies, offering convenience for travelers or those dealing with multiple currencies regularly.

- Speed is crucial in your international money transfers, as Wise is known for its swift transfer times, ensuring funds reach their destination quickly and efficiently.

Alternatives to Payoneer & Wise

Promotions on Payments software

Start saving on the best SaaS with Secret.

Secret has already helped tens of thousands of startups save millions on the best SaaS like Payoneer, Wise & many more. Join Secret now to buy software the smart way.